Volatility Surface & Skew

Volatility Surface

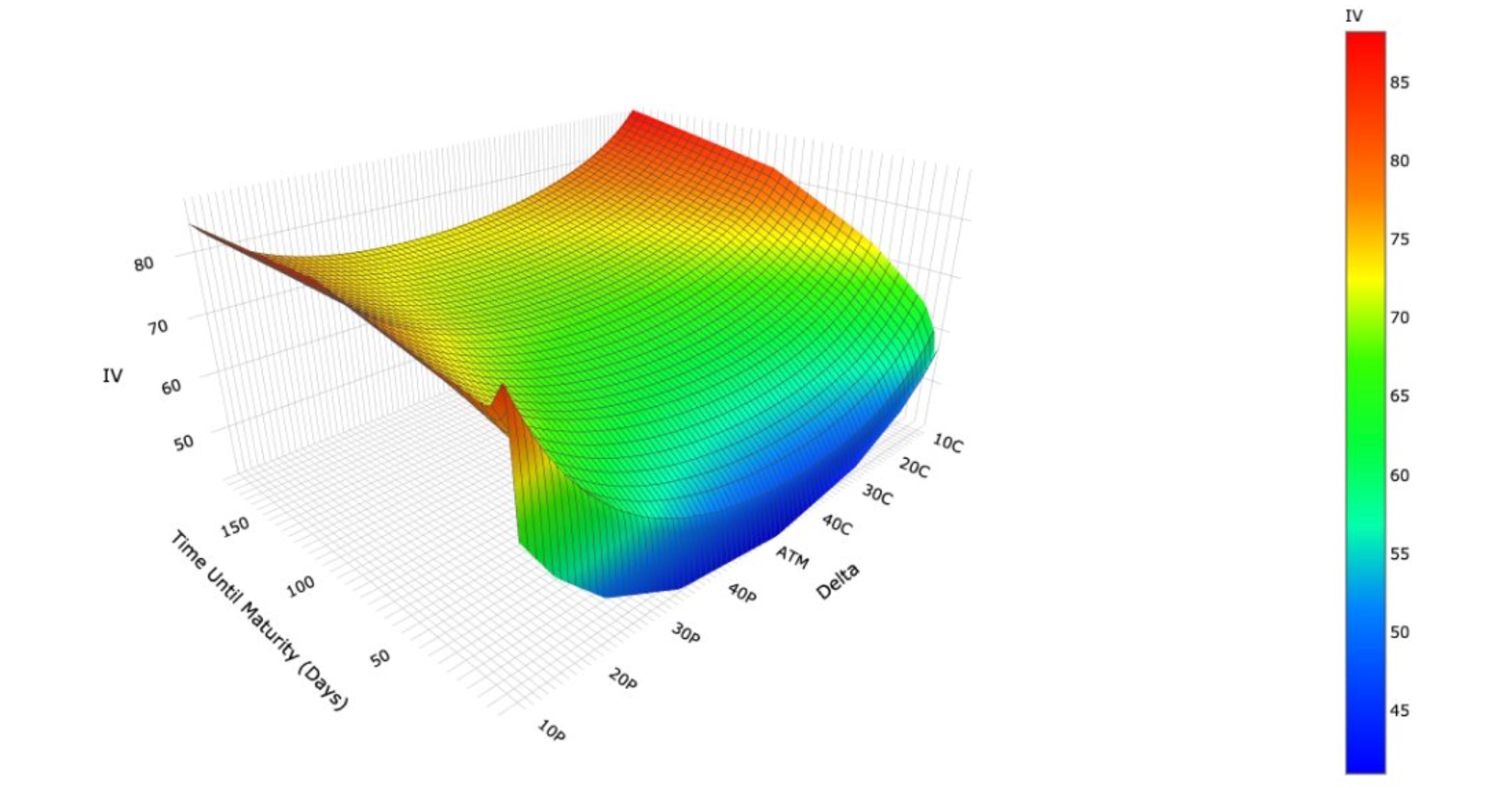

In the context of options trading, a volatility surface is a three-dimensional graphical representation of implied volatilities that are plotted over different strike prices and expiration dates. It's a useful tool that helps traders visualize how implied volatility changes for options contracts across various strike prices and expirations.

The volatility surface essentially shows how the market's expectation of future volatility (as expressed through option prices) varies for options that are in-the-money, at-the-money, and out-of-the-money, and how this changes as the options approach expiry. This helps traders assess market sentiment and develop trading strategies accordingly.

It's important to note that the shape and structure of the volatility surface can change over time based on market conditions and sentiment.

Skew

In options trading, the term "skew" refers to the phenomenon where options on the same underlying asset with the same expiration date have different implied volatilities based on their strike prices.

Typically, you might see implied volatility decrease or increase as the strike price gets farther away from the current trading price of the underlying asset. This phenomenon can be visualized through a "volatility skew" graph, where implied volatility is plotted against various strike prices.

Skew often occurs because market participants perceive the probabilities of extreme price movements differently. For example, for equity options, the market generally perceives that extreme downward moves (i.e., significant drops in stock prices) are more likely than extreme upward moves. This results in put options (which become more valuable when prices fall) having higher implied volatilities than call options (which become more valuable when prices rise) - a pattern known as "negative skew" or "volatility smile".

Conversely, for commodities like oil, extreme upward moves (like a supply shock) are often perceived as more likely, leading to a "positive skew" or "volatility smirk", where call options have higher implied volatilities.

Understanding skew is important for options traders, as it provides insights into the market's expectations of future price movements and can affect the pricing and selection of options strategies.