Overview

Protocol Architecture

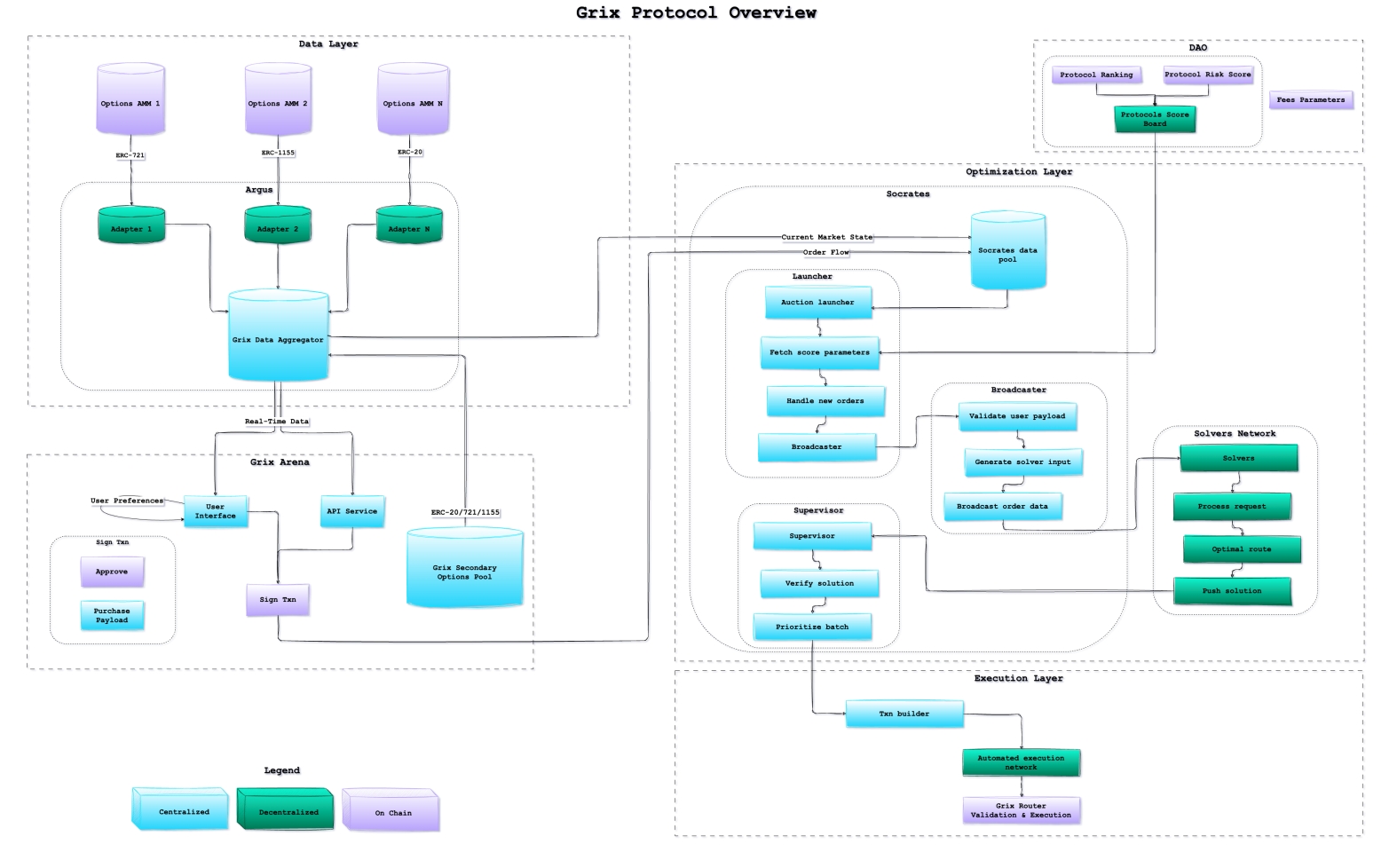

The Grix architecture at its core consists of 4 main layers:

Each layer is responsible for different aspects of the protocol.

Below is a technical overview of Grix protocol:

How Grix works? (ELI5)

The Data Layer aggregates and indexes the relevant data from all sources (on-chain protocols, market data, existing submitted intents) into Argus, which holds the current state of the DeFi options market, used for computation of the optimal route for the order flow.

The Grix Arena is the traders interface, it is separated to a simple trade view and a more advanced option matrix trading component. Options buyers can trade at optimal market price or place limit orders via the Grix Arena. Options sellers can sell at optimal market price or place limit orders (using the intent based trading facilitated by Grix), which acts as an additional liquidity source for traders. The entire order flow is routed to the optimization layer.

The Optimization Layer is responsible for selecting the optimal route by conducting an "auction" involving a decentralized collective of solvers, all solving (hence the name Solvers) and bidding on the optimum solution. The component managing the interactions with the solvers network is called Socrates.

The Execution Layer is responsible for building and executing the users' transactions with the maximum precision and lowest fees, utilizing the benefits of smart contract router validation and decentralized execution. Transactions are executed via the Grix router and fees are distributed between the winning solver and Grix protocol.