Token Distribution

GRIX Tokenomics

Grix Foundation (18%) — Reserved for the Grix Treasury, to be used for development, marketing, partnerships, and operational costs.

Incentives (36%) — Allocated for ecosystem incentives such as trade incentives, staking rewards, partnerships, and liquidity mining.

Core Team (24%) — Allocated to current and future core team members to align incentives and ensure long-term commitment.

Advisors (8%) — Reserved for current and future advisors to the protocol.

Investors (4.7%) — Allocated to private investors from previous rounds (Seed and Private rounds).

KOLs (0.1%) — Allocated to KOLs who participated in the KOL round.

Liquidity (2.5%) — Used to seed initial liquidity across various pools.

Reserve (6.7%) — Reserved by the Grix Foundation for future allocation decisions.

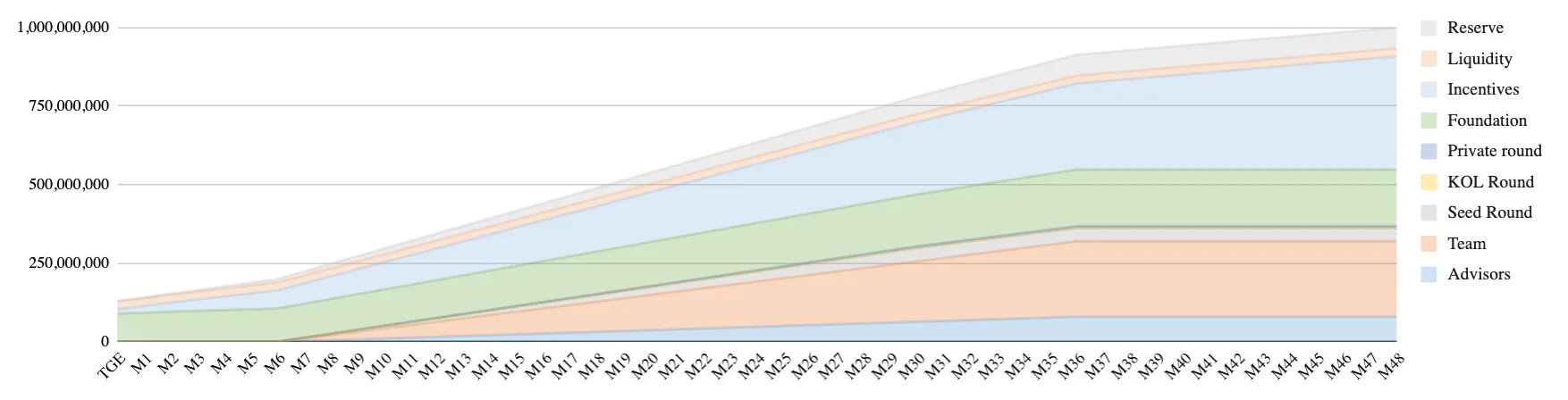

Vesting Schedule

GRIX tokens allocated to the Team, Advisors, and Investors are subject to a vesting schedule:

Team: 6 month cliff, 30 months linear vesting after.

Advisors: 6 month cliff, 30 months linear vesting after.

Investors: 6 month cliff, 24 months linear vesting after.

Emissions Schedule

The GRIX token follows a carefully designed emissions schedule to balance rewards for early adopters and long-term sustainability. The emissions will decrease over time, ensuring a gradual reduction in token inflation.